That’s what I’m talking about! So it took you two years to break even (plus your sweat equity) and you tripled your money in four years. I would say those numbers work.

If you cant self fund your growth through your business you are doing it wrong… I am not against getting a line of credit if your growth is extreme…

Money is necessary for growth, whether borrowed or from in house resources. I wouldn’t want a situation where anyone had a say in the growth of my business. Henry Ford used investors to grow large and later regretted it. The investors wanted to see a large return, Ford wanted to reinvest earnings for future growth. Using some available resources such as low cost loans for vehicles can actually be profitable.

They have had service businesses, a food truck comes to mind ATM and they turned it into a very profitable franchise

I’m keeping an eye on you @Kyle_Stafford because I enjoy your comments…

My favorite part is we are not far off from each other, but just far enough to make it fun.

And this is the interesting part of the (I’m assuming) hypothetical situation.

Like I said earlier, we are taking this situation internally.

So you and I might be thinking "you should be able to afford to use your own cash by now"

and “I don’t need anyone’s help NOW.”

And that’s where I think most who have posted are in the mindset, scrolling through the members who have responded.

But if we were fairly new, and (finally) saw some good numbers that we had never experienced before…

The temptation would/could be there.

If someone had come to me in say, year two or so of my business, I would have taken the $50k and ran with it.

“Sky’s the limit” mentality at that point.

Another part is, you could also feel like why not 'grow on someone else’s dime?'

And then we start thinking, it’s not someone else’s dime… it’s mine.

- I just gave someone ‘change for a dollar’ with 12 dimes.

Not only do you have to give him 12 dimes , but also most investors want to own a % of your business .

I’ve been self employed “successfully” since I was 19. And if there is one thing I can narrow down why I have obtained any level of success is because of discipline. Disciplined to be organized with Finances, Disciplined to seek a clear vision for what I am trying to achieve, Disciplined to humble myself and listen to those that can give valuable advice, and Disciplined in my personal life so that I am not losing focus on the responsibilities I have to myself, customers, employees, etc.

The reason I say this is because in business rarely does success come fast and “overnight”. Solid success in business happens slowly and overtime…with careful planning and execution along the way.

If you feel like your business is sputtering and you need an investment… money is not your problem, your strategy and execution is your problem

D[quote=“Kyle_Stafford, post:29, topic:35484”]

The reason I say this is because in business rarely does success come fast and “overnight”. Solid success in business happens slowly and overtime…with careful planning and execution along the way.

[/quote]

“To paraphrase Steve Jobs, “I’m always amazed how overnight successes take a helluva long time.”

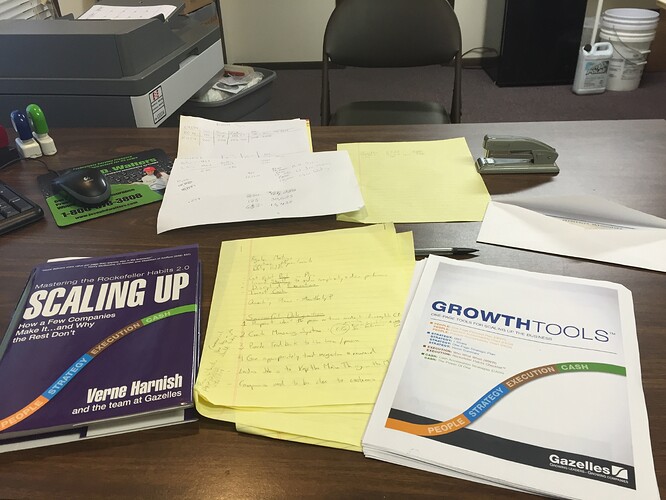

Excerpt From: Harnish, Verne. “Scaling Up.” Gazelles, 2014. iBooks.

This material may be protected by copyright.

Check out this book on the iBooks Store: https://itunes.apple.com/WebObjects/MZStore.woa/wa/viewBook?id=925973122

@c_wininger lol that is my new favorite book. I’ve read it twice this winter

If you dont have a plan in place to turn the “dollar” loan into 10 dollars, while paying back only 12 dimes, then you definitely do not want to look for a loan

For me it would have to be low risk compared to high risk.

Low risk - borrowing money to buy a established business as to high risk borrowing money to try an establish more business.

If it’s high risk I would rather get there slowly than do something I would greatly regret if things went array.

Re-invest the profits with no interest tied to it.

one of my recent readings pointed out if one wants to grow exponentially very quickly

buy an unrelated business that you can cross market services to

growth 1. a strategic aquisition

growth 2, cross marketing one service to cust base of other

growth 3 cross marketing the other business services to the opposite cust base

growth 4 efficiency profits - trimming redundancies of the 2 businesses now combined (admin, mgrs., etc)

Carpet cleaning or a pool route

or simply start a companion service biz that you can accelerate quickly based off your existing client base, ie., window cleaning company starts lawn care/snow removal service and can acquire 200 customers immediately.

Not in Southern California

Hate to get off topic, but I think that’s a great idea!!

It’s my Summer Project 2016.

And in my research/planning, I’ve seen companies that sell plans and sometimes accompanying materials.

I’D possibly be a customer.

Incidentally- Inside Joke

There are a handful of people who were subjected to me learning to post pics from my Ipad.

- forced to look at my ‘yardwork/projects’ images all summer long.

@Chris I promise not to post 1000 pics of me stumbling my way through building a shed, this summer! ![]()