lol. Thats why its funny…

How do you afford things that’s very little

Charge more

Just spitballing here, I don’t know Chad’s actual numbers (and I think it’d be rude to ask). But…

12 workdays per month, x 6 hours per day, x $125/hr = $9000/month

x 11 months (guessing here; Chad is in Louisiana) = $99k/year

Or approximately $65-$75k take-home, after taxes and expenses. That’s a pretty darn comfortable living in many parts of the country, especially if you’re frugal. And it’s still low enough that a married couple can get health insurance subsidized through the ACA

I live well within my means. I am also not married, no kids, no house note and no vehicle note. That helps a lot.

Not asking for his numbers and I was afraid that would come off bad I am just saying That’s not a lot of hours to pay bills and have a retirement of course everyone’s economy and spending habits are different and who knows maybe he has a side hustle or is a master in the stock market.

Feel free to PM me

Who lol

You  . I saw you had some questions about how 99k gross could work out to $65k take-home, but you deleted your comment. So I figured you might want to keep that conversation private.

. I saw you had some questions about how 99k gross could work out to $65k take-home, but you deleted your comment. So I figured you might want to keep that conversation private.

But the invitation is open to anyone. Happy to share some numbers privately.

Well guess I can’t overlook the 45 k. If I didn’t have a 30k truck or payroll that adds 45 k to my income but then more tax so not sure how that would have squashed out. I’d like to net $100 k after expenses take home in my pocket.

Talk to your cpa and ask him what if’s , everyone one is different. A single young male will always pay more in taxes than a older married male with kids and a mortgage .

Also I hope you’re an LLc or s Corp , that will help with taxes . You might have to put your self on payroll(w2) with quarterly distributions , to save taxes . Anyways talk to your cpa

I’m a Sole Proprietorship but have been told to become an LLC for liability reasons.

Nobody pays more taxes than sole proprietorships. Ask your cpa about making the s-corp election. You can search my name and s-corp for more info.

Also, a solo operator in ‘sustain mode’ (vs. what you’re probably experiencing, ‘growth mode’) can really trim business expenses to a minimum. Especially if you’re focusing on just one or two services.

I’m betting Chad’s marketing budget is similar to mine: almost nonexistent.

Then you consider: get a low cost to operate work vehicle, home office (no shop rent) etc. and there’s not a whole lot other than your insurances and basic supplies to keep you in business.

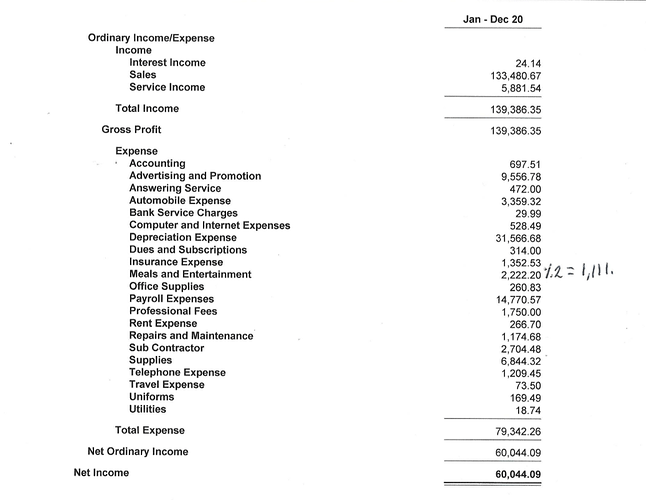

If you want some numbers, here you go:

2019

We had 102k gross sales.

After business expenses (including employer portion of payroll taxes) we had a “household gross income” of $77kish. That was split between about $41k in payroll and the rest in quarterly distributions.

We paid in $8kish in employee portion payroll taxes, and about $5k in estimated taxes on the distributions (but much of that actually was applied towards APTC repayments for making more than we expected; it was really for health insurance, not taxes).

That brought our household income down to $64k take-home, after taxes.

And we had a fairly decent sized refund to apply towards 2020 taxes. So in actuality, our “take home” would’ve been more than $64k, had we paid in less on the estimated taxes.

Also, we were informed after the fact by our cpa, that for our situation we could have taken a smaller salary, perhaps around $35kish, and taken a little more in distributions, saving us even more.

So that’s where I come up with $99k possibly working out to $65-$75k take home. Controlling expenses, and effective tax planning.

I am a one person window washer. I do strictly just windows and charge competitive prices but am very efficient. My vehicle set up is great because I have all my tools at all times, it’s clean & accessible and I have a low cost but efficient pure water set up and I’m fast at windows/skilled. No office just my phone & laptop and print very little as almost all of my customer interaction is email or text. Also getting to a point where I’m able to advertise less. However less cost is more money in your pocket but less write offs higher taxes so not sure how that works.

I have a 2014 Nissan NV200 that runs and looks like it’s brand new but was only 14 k. Could have got a smaller one for less gas but would have traded off effiency.To start with, “the more you make, the more they take.” But as pointed out in the book “Simple Numbers”, a big tax bill isn’t the worst thing; it’s evidence that you’re profitable. And the tax man is only going to be taking a slice of that pie.

There’s a lot you can do to optimize your tax situation, though. You are at a point where you would absolutely benefit from restructuring as an S-corp. instead of all your profits being taxed as self-employment income, you would pay yourself a small but reasonable salary as a W2 employee, and then take quarterly profit distributions to supplement. That additional income is only taxed as “normal income”, at the standard tax bracket. There’s no SS/FICA collected on those profits.

I can’t make any promises, but I’m betting you’d save $5-6k/year at least by restructuring. Say for example you had $40k in distributions: 40,000 x 15.3% = $6,120 saved in SS/FICA.

Also, I just looked at your P&L sheet again. So your $60k is after taking $30k in depreciation on something (I forget what you said that was for)

But that’s different from what you’re able to pay yourself. That $30k didn’t actually come out of your account all at once, right? It was financed I assume, but depreciated all at once for the write off (which for your situation, was probably a smart move).

Also, $9500+ in advertising. That won’t always be that high, if you plan on remaining a solo op. I think our advertising this year was around $1k, and included yard signs, our website hosting, and lettered shirts.

Thanks for sharing your full P&L sheet, btw. Quite a few people are comfortable throwing out their gross numbers for the year, but there’s rarely any reference to their expenses and what they actually got to keep out it.

A lot of useful info here.

I’m real curious what my numbers will be my 2nd year. My first year I was at a loss so paid no tax.

I’m just curious, so it looks like I have an LLC. Doesn’t specific what, etc so I believe just an LLC.

From here I can go the S-corp route or the C-corp route I believe?

I could probably look up what c-corp is and learn about it but when should I consider going to the S-corp route?

From my limited research, I think C-corp becomes useful when you have a number of employees. Otherwise it can cost you more in taxes and paperwork, IIRC. (Also, I don’t believe you can go C-corp as an LLC. It’s an actual corporate structure.)

S-corp is really more a tax classification than an actual “structure”. You can make the s-corp election as either an LLC (Limited Liability Company) or a traditional Inc.

It’s what’s known as a “pass through entity”; profits are not taxed at the corporate level. They are passed through to the shareholder(s) and taxed at the individual level, at the standard tax bracket (sans SS & FICA).

Hope that doesn’t make things more confusing.

Without making the s-corp election, a regular LLC is also considered a pass-through entity, but the profits are taxed to the shareholder(s) as self-employment income, and you pay SS & FICA on the full amount. That’s what I’m guessing you’re set up as, @Narcos.

If doesn’t all make 100% sense, that’s ok. It took me until year 2 or so of actually being incorporated, before it started to really click in my head. I like math, but I hate tax codes and the vernacular that comes with them. You’ll have to learn weird concepts like “basis” and “shareholder contribution”. Even words like debit and credit have a weird reversal in meaning. It’s nuts.

Exactly, you have to find a happy medium place that works for you . You might kill yourself to make that net 100k or you can take it easy and net 70-60k. Again talk to your cpa . Also if you haven’t yet, pick up some business books on finances and taxes

I’m clearly in the minority here, so I’ll share. I have 12-15 cleaners depending on time of year and how many part-timers on staff. Full time field manager, full time office/operations manager, part time office assistant. I work 4 days a week, 5-6 hours a day. In 2019 (last year before global pandemic) I took 11 weeks of vacation.

It’s all about personal preference. I built my business this way intentionally because it’s what I want. Everything in life is a trade-off. I trade headaches of employees for lots of time off and more income, but that’s my personal choice. For me, it’s worth it, but I wouldn’t tell anyone there is a better or worse way to do it.

There is definitely a tipping point where if you’re going to add employees, you kind of lose money until you grow big enough to have a handful of employees, as Narcos said. We are structured as an LLC that has elected to file as an S-Corp. For my situation that was best for taxes.

Do what makes you happy. If you want a big company, grow a big company. If you want to work alone or with a helper, then do that.