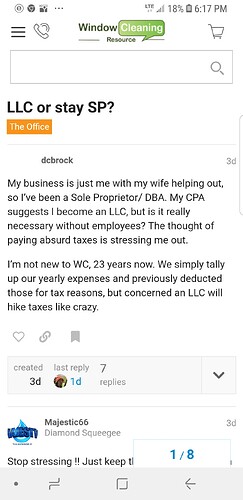

Hello everyone, im new to the forum and have a quick question that some of you can help me with. Im starting a wc business in CA and i have the name all figured out and got the DBA, some people have told me to go with an LLC but, in CA it is very expensive to get one. I know a few business owners that said a DBA should be fine just starting out but, then sme others said go with LLC. Im about to get a sole Proprietorship with general liabaility inaurance and maybe professional insurance. I would be the only one working the business as well. Anybody think a Sole Proprietorship is fine until i get some growth?

Thank You,

Just a heads up , people on here get really annoyed when new people come on here and ask stuff that was just asked. Not being rude but I guarantee you this is right at the front of threads just posted 3 days ago. It makes people feel like you are posting just to post when you ask something just posted.

I’ve been on a few years and I’m not annoyed. OP fwiw, I’m so glad I never got an LLC when I started. As a sole proprietor your not required to report every quarter and pay as far as I know, an LLC is. You are way better off seeing if the ball is round and rolls right for YOU before you go get an LLC. It’s way easier to just dissolve your Sole Prop or just moonlight with it if you need to get a job to help you on your feet.

Good ol’ Kalifornia. They try to quash self employment every chance they get.

Just be a DBA for now, that’s what I did for years. The only reason why I’m looking at an LLC now is we are closing on a house finally and have added PW to long time WC business. Just watch out for yourself, don’t be put in a compromising situation that could get you sued.