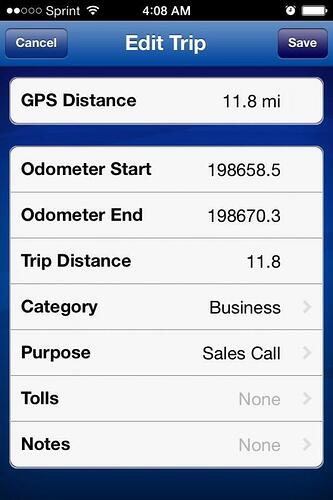

Not sure what others do to track mileage for work but I was mega-failing at the little mileage books you buy from Staples / Office Depot. Started looking and there are a few apps for iPhone/android which basically do the work for you. Earlier this week I settled on one called automilez after my research, I couldn’t be happier. Tap & go! This one already paid for itself. Uses GPS and is pretty accurate.

I have a small book I keep in the truck & write down the address & mileage when I go do a bid. That’s cool. Go an look into the app

Sent from my iPhone using Window Cleaning Resource mobile app

I have Milebug. I loaded it awhile ago but didn’t use it. I recently started using it and love it. Best of all, it’s free. Easy to use easy to read. I can put both of my businesses to keep mileage separate and since I have more than one vehicle, I can enter mileage for either vehicle. I can backup to itunes and the Cloud so i dont lose anything and i can print for taxes. Works well. I should have thrown the little book away a long time ago.

I use to use the book/log. Always forgot to fill it out. About 3 years ago I made an Excel tracker. Use to be a macro code guru in the day but this is basic. It’s Groundhog Day, same routes every day. Computed the mileage for each route and commuter mileage. Made a 365 day sheet and loaded the days and routes. Typical sheet adds miles, minuses commuter by day. If I use a book or a tracker for the odd days off my beaten path or supply shopping I just add those extra miles in another field.

I forgot about the App trackers so thanks for the reminder. Used the other day and liked it. Of course, forgot ending miles but easy enough to do a quick map search of route and verify miles. I can use the report to update sheet. Cool. I can put in start year and end year and it tells me business, personal, commuter, additional tasks. I literally drive the same thing and miles from point A to point B never changes. Generally the vehicle is 50- 75% business anyway. If a book is requested I can trans the data to a new book. Take some time but have a book ready if IRS wants it. Can validate by invoices showing paid for services on that day as well as using a distance tool to validate miles between points.

Works for me because I like to do stuff like that. Will use the App more often. Beats looking to see if I have the book, avoids scrap papers and notes on cell. Pop in address and start miles. Forget end it will figure it out for me if GPS is turned on.

I have to make some numbers up at the end of the year.

Sent from my iPhone using Window Cleaning Resource mobile app

Me too ^^^^…But do they still need mileage if I’m on bicycle??? Hmmmm… But I’m still going to write off the 3 piece suits and the dry cleaning.

Sweet

They need the mileage to reimburse for the knee replacement.

I always forget to write it in the book. And I always forget to turn the app on. Best thing that works for me is writing the mileage on the invoice. I print two invoices per job. One goes to the customer. The other gets all of the notes i have from the job, the mileage, how it was paid and if they paid by check I staple that to it, and it gets filed

I usually take my checks to the bank. But I guess filing them is an option too.

I’m old-fashioned. I set my vehicle’s trip odometer to zero each day. When I get home I write it on my wife’s yellow pad which also asks for employee’s hours and parking fees. Works like a charm!

LMAO. Here I was wondering why I was broke!

I make my deposits online at the end of the day. You are supposed to hold on to the check for a certain amount of time so I staple them to the invoice.