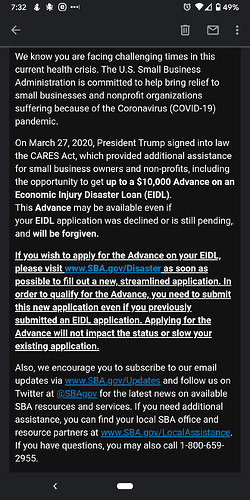

So I got an email form the SBA about getting a $10k advance that is forgiveable even if you’re declined for a disaster loan. The streamlined application took 2 minutes for me to do

Just filled it out. We’ll see what happens.

Here’s the direct link: https://covid19relief.sba.gov/#/

Are you solo Alex? I can’t remember. Wondering how this works for sole proprietors w/ no employees.

I applied for that as well.

I just got off the phone with my bank.

Apparently there is a scramble within the banks to find out which application they are supposed to be using and other minutae to get the process started. I was told to call back Thursday or Friday to get the ball rolling, but I will also be calling them tomorrow.

My wife and I are a two person s-corp. But I work in the field solo.

Sole proprietors are eligible, though.

Alex, do you happen to have an opinion if sole props can get forgiveness? Just switched over to LLC, but don’t have any payroll history so I would think I have to come in under sole prop.

That’d be a question for your CPA. Though they might not even have a clear cut answer at this point.

But from the video that @Chris posted, you can get forgiveness for anything spent in the first 8 weeks as long as it falls into one of the categories listed. There were other eligible expenses listed besides payroll. (I think operating expenses like rent, loan payments, etc, were mentioned. I would have to rewatch.)

Thanks Alex. Just submitted my application. Personally, I’m feeling this is ‘throwing money in the streets’ situation. But hey, if so might want some for souvenirs.

Very helpful @Chris! Thank you!

@Infinity I will probably have too. I didnt think I would have a chance of getting anything, but from the article Chris posted I may qualify.

From the PDF

"What counts as payroll costs? Payroll costs include:"

"For a sole proprietor or independent contractor: wages, commissions, income, or net

earnings from self-employment, capped at $100,000 on an annualized basis for each

employee."

Does this mean as a solo sole proprietor operation we can get approved for loan, use that loan amount as “wage” payment to ourselves, and then have it forgiven?

That is correct based on what the application from the treasury department says. However, it also states that you do have to submit your payroll documentation from the previous year. So if you don’t actually pay yourself payroll, I’m not sure you will qualify in that scenario. Not sure though. Talk to an SBA Lender.

Oh, and its only for what you spend within 8 weeks after getting the money.

Hoping it can be used to pay back-wages. We didn’t take any payroll for March, and hardly anything for February, because of being so tight this year

I never payed myself payroll, all the checks I got went directly in my business bank account and I withdrew money from there into my checking account on a needed basis, hopefully that won’t disqualify me and others like me.

Assuming that even under those conditions I mentioned above, I still qualify for the forgivable loan, I wonder how much we could qualify for as sole proprietors with no employees to have forgiven?

Could I theoretically qualify for 20k, give myself two payments of 10k a month for the first 8 weeks, and then have that forgiven? So many unknowns.

So, I’m a bit confused. Do you apply online as Alex did or through an existing SBA lender as the PDF says? Or are these two separate types of loans through the SBA?